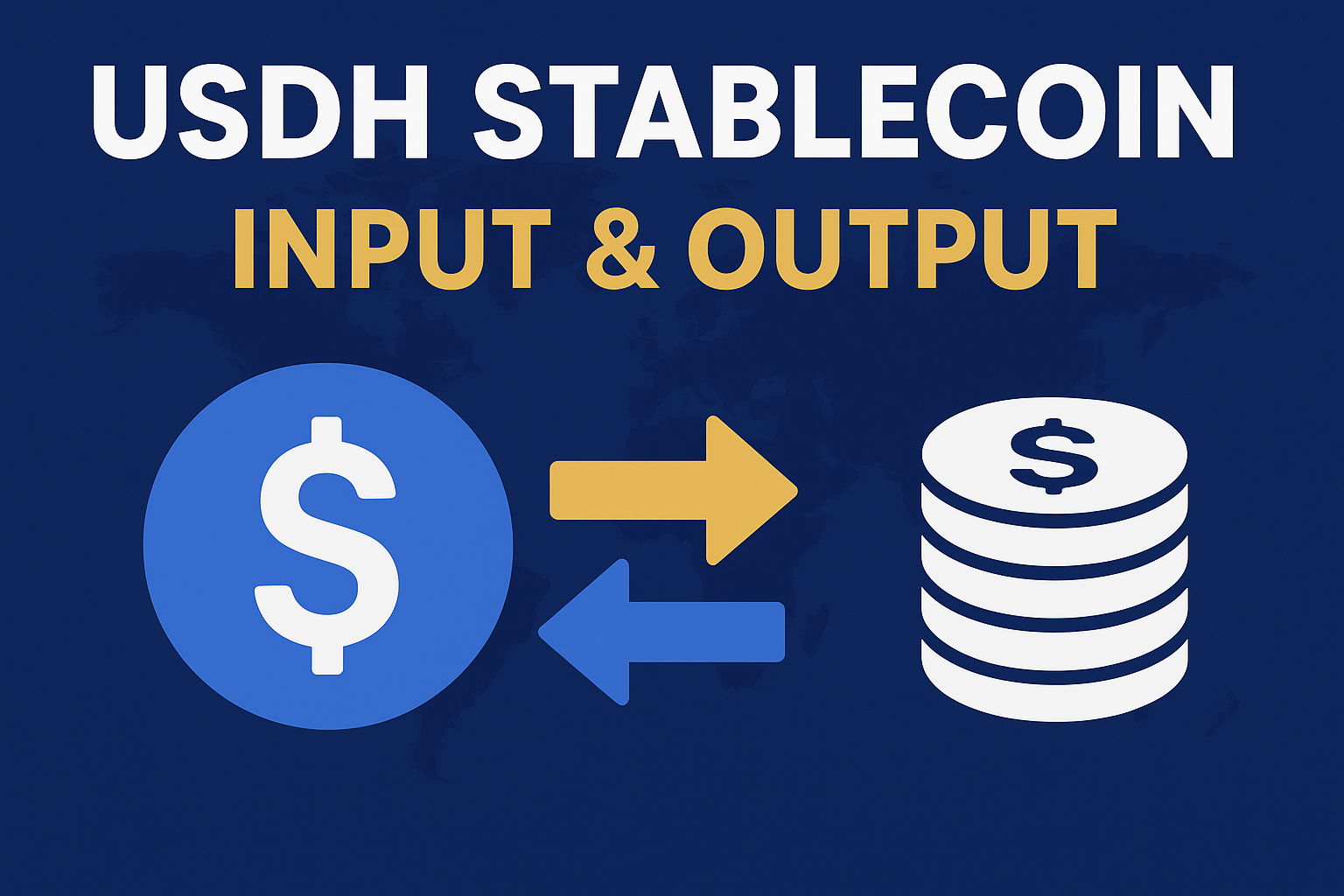

In the rapidly evolving stablecoin space, USDH has emerged as a token of interest. Investors and crypto users alike are asking not just “What is USDH?” but also “How does its economic engine work?” This article breaks down the input mechanisms, internal flows, and output dynamics of USDH — giving you clarity on how value is created, maintained, and distributed.

What Is USDH Stablecoin?

Definition & Purpose

USDH is a stablecoin designed to maintain a peg (typically 1:1) with the U.S. dollar by using collateral, algorithmic mechanisms, or hybrid systems. It aims to offer stability while enabling DeFi functions (staking, yield, transfers, etc.).

Key Attributes

- Dollar-peg (ideally)

- Transparent reserves or collateral backing

- Smart contracts for minting, burning, arbitrage

- Integration with DeFi (liquidity, yield)

Input Side: How USDH Is Minted, Funded & Backed

To understand the “input” side, think: How does USDH come into existence? What assets or mechanisms support it?

Collateral / Reserve Assets

Most stablecoins rely on reserves or collateral. USDH may accept deposits or lock assets (e.g. USDC, USDT, ETH, or other crypto) in smart contracts as backing. These reserves act as the safety net for USDH’s value.

Minting Mechanism

To mint USDH, a user deposits collateral assets into a smart contract. The protocol issues an equivalent amount of USDH based on pre-defined ratios. If overcollateralization is required (e.g. 150%), the system demands more collateral than USDH issued to protect against volatility.

Fees, Interest & Incentives

Some USDH systems charge a minting fee or a stability fee. The collected fees may be distributed to protocol stakeholders or used to maintain the peg. Users might also earn yield for locking collateral (e.g. via staking pools or lending).

Oracles & Peg Monitoring

Oracles feed real-time price data (e.g. USD exchange rates, collateral valuations) into the protocol. If USDH’s market price deviates from $1, automated arbitrage triggers minting or burning to restore balance.

Internal Flow & Mechanics (Value Circulation)

Once USDH exists, how does it circulate, stabilize, and sustain itself?

Liquidity Pools & Exchanges

USDH pairs (e.g. USDH/ETH or USDH/USDC) on decentralized exchanges (DEX) provide trading liquidity. Liquidity providers (LPs) earn fees from trades. These pools are critical for price discovery and arbitrage.

Arbitrage & Peg Enforcement

When USDH trades slightly above or below $1, arbitrageurs intervene:

- If USDH > $1, they mint new USDH (depositing collateral) and sell to bring it down.

- If USDH < $1, they buy USDH cheaply and redeem (burn) it, pulling supply back.

Redemption / Burning

Users can redeem USDH in exchange for collateral (or equivalent value) via the protocol. This destroys (burns) USDH, reducing supply and reinforcing the peg.

Yield Distribution & Governance

If the protocol collects surplus (from fees or interest spreads), it may distribute rewards to USDH holders, stakeholders, or governance token holders. This encourages token holding and network participation.

Output Side: How USDH Delivers Value

Now, on the “output” side: Where does USDH send value? What benefits accrue to holders, users, or the protocol?

Stability & Medium of Exchange

USDH provides a less volatile medium of exchange (compared to volatile cryptos), suitable for payments, remittances, or transfers in DeFi systems.

Yield & Returns

Holders or liquidity providers can earn yields via staking, lending, or protocol rewards based on usage and fees collected.

Capital Efficiency in DeFi

USDH can be used as collateral, paired in liquidity pools, or borrowed/lent — unlocking more capital efficiency in DeFi ecosystems compared to idle fiat.

Network Rewards & Tokenomics

The protocol may reward loyal users or stakers with governance tokens, bonus USDH, or other incentives — aligning user behavior with system health.

Risks, Challenges & Considerations

- Collateral Volatility: If reserve assets drop sharply, peg may break.

- Oracle Manipulation: Faulty or malicious oracle data can cause mispricing.

- Redemption Delays: Liquidity bottlenecks may hinder prompt redemption.

- Protocol Governance Risks: Poor governance decisions or exploits could undermine trust.

- Regulatory Pressure: Stablecoins face scrutiny from regulators regarding reserves, consumer protection, and transparency.

Why “Own” USDH? Use Cases & Strategic Value

- Hedging: Use USDH as a stable hedge in crypto portfolios.

- DeFi Access: Participate in lending, liquidity provision, staking using USDH.

- Arbitrage Opportunities: Take advantage of peg deviations for profit.

- Network Growth: If USDH becomes widely accepted, holding early tokens may offer upside.

- Payments & Remittances: Use USDH for cross-border transfers with lower friction.

Conclusion

The input-output framework reveals the lifecycle of USDH — from how it’s minted (inputs) to how its value circulates and returns (outputs). Understanding these mechanisms is key to evaluating whether USDH is “good to own.” Its strength hinges on robust collateral, sound governance, liquidity, and safeguards against volatility and system stress.