The Bitcoin mining industry outlook for 2025 paints a fascinating picture of technological evolution, rising sustainability efforts, and growing institutional investment. As Bitcoin continues to solidify its place in the global economy, miners worldwide are preparing for a year defined by efficiency, regulation, and renewable energy transformation.

In this article, we’ll dive deep into the key trends, challenges, and opportunities shaping the Bitcoin mining landscape in 2025, exploring how the next wave of innovation is reshaping this trillion-dollar ecosystem.

⚙️ 1. The Current State of Bitcoin Mining

Bitcoin mining serves as the backbone of the Proof-of-Work (PoW) consensus system, ensuring the network’s integrity while distributing new BTC into circulation.

After the 2024 Bitcoin halving, mining rewards were cut from 6.25 BTC to 3.125 BTC per block — a significant shift that redefined profitability metrics for miners globally. The immediate impact was a wave of consolidation as smaller operations either upgraded to more energy-efficient hardware or exited the market.

According to CoinDesk’s mining report, the industry’s hash rate surged past 700 EH/s by late 2024, demonstrating continued resilience and investment despite increasing difficulty levels.

⚡ 2. Rising Mining Difficulty and Hashrate Growth

By 2025, Bitcoin’s total hashrate — a measure of computational power — is projected to surpass 850 EH/s, signaling an unprecedented level of network security and competitiveness.

This growth stems from two primary factors:

- Institutional-scale mining farms expanding across North America, the Middle East, and Scandinavia.

- Next-generation ASIC miners like Bitmain’s Antminer S21 and MicroBT’s WhatsMiner M60 boasting record-breaking efficiency levels of below 20 J/TH.

Mining difficulty is expected to rise by another 10–15%, making efficiency and access to cheap energy the decisive factors for profitability in 2025.

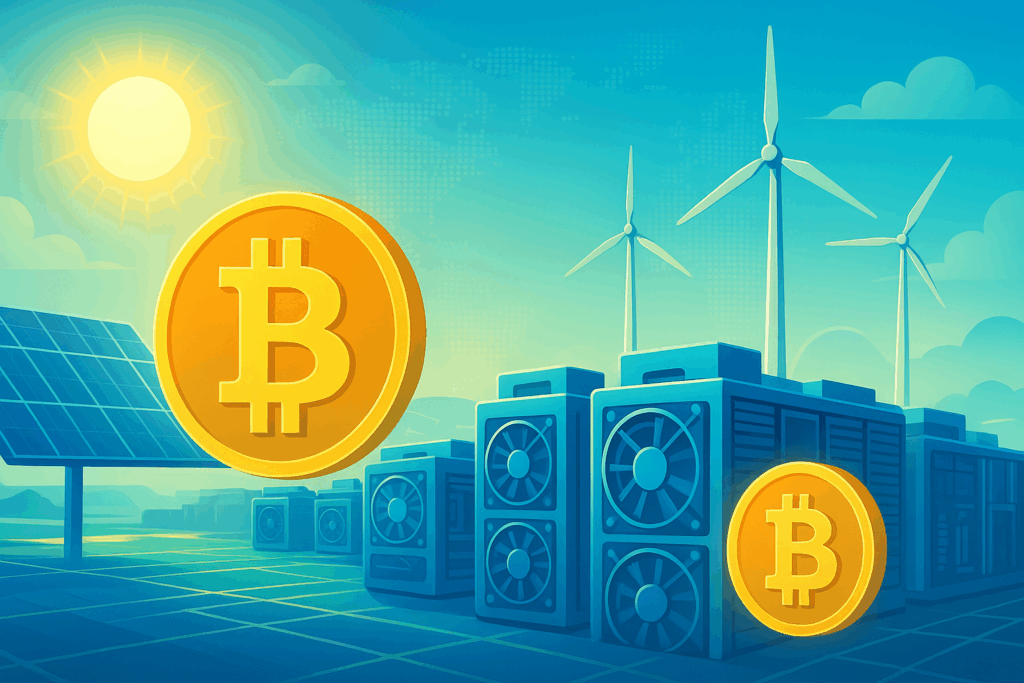

🌍 3. The Shift Toward Sustainable Bitcoin Mining

Sustainability has evolved from a buzzword into a core business strategy. With global scrutiny on Bitcoin’s energy consumption, mining companies are now embracing renewable power solutions such as:

- Hydroelectric farms in Paraguay and Canada

- Solar-powered operations in Texas and the UAE

- Geothermal mining in El Salvador

The Bitcoin Mining Council (BMC) reports that 59% of global mining now uses renewable energy sources, with the figure expected to exceed 65% by the end of 2025.

This sustainability drive not only boosts public perception but also ensures long-term viability as carbon-neutral crypto policies gain traction.

💰 4. Profitability Outlook: Is Mining Still Worth It?

Despite reduced rewards post-halving, the profitability outlook remains cautiously optimistic. Bitcoin’s price — which analysts from Bloomberg predict could range between $90,000–$130,000 by late 2025 — is a major factor influencing miner returns.

Moreover:

- Cheap renewable energy in certain regions is offsetting operational costs.

- AI-powered cooling and monitoring systems are reducing downtime and energy waste.

- Smart grid partnerships are emerging, where miners sell back unused electricity during off-peak hours.

With the global average mining cost per BTC expected to hover around $42,000–$50,000, most efficient operations will remain profitable as long as Bitcoin stays above this threshold.

🧠 5. Technological Innovations Reshaping Mining in 2025

The next phase of Bitcoin mining is defined by innovation and automation. Leading advancements include:

- Immersion Cooling Systems: Advanced cooling technology that increases miner longevity and efficiency.

- AI & Machine Learning Analytics: Used for predictive maintenance and optimization of mining operations.

- Blockchain Energy Grids: Integrating mining operations with renewable microgrids to balance power loads dynamically.

- ASIC Efficiency Race: Manufacturers like Bitmain, Canaan, and MicroBT continue to push energy-per-hash metrics to all-time lows.

These innovations make modern mining more sustainable, scalable, and profitable than ever before.

🏛️ 6. The Regulatory Landscape: More Clarity, Less Fear

Regulation remains a wildcard — but 2025 could finally mark a turning point. Governments are transitioning from restriction to strategic regulation, recognizing the economic value of hosting mining operations.

For example:

- Texas and Wyoming (USA) have introduced tax incentives for renewable mining projects.

- Kazakhstan is establishing green zones dedicated to low-impact crypto mining.

- The EU’s MiCA framework aims to ensure energy transparency and reporting for all mining firms.

Such measures may help legitimize the mining industry further and attract new waves of institutional capital.

(Source: European Commission MiCA)

📈 7. Investment Opportunities in the Mining Ecosystem

The Bitcoin mining sector is attracting both private and institutional investors in 2025. Companies such as Marathon Digital, Riot Platforms, and CleanSpark are expanding aggressively, while retail miners explore profit-sharing platforms and decentralized mining pools.

Investors seeking indirect exposure can explore:

- Publicly listed mining companies (Riot Platforms)

- Mining ETFs and Bitcoin infrastructure funds

- Renewable-energy crypto projects focused on sustainability

With Bitcoin’s fixed supply and increasing institutional trust, 2025 could represent a golden era for strategic mining investments.

🌐 8. Global Hotspots for Bitcoin Mining in 2025

Regional dynamics are shifting as countries compete for mining dominance.

| Region | Key Advantage | Outlook |

|---|---|---|

| USA (Texas, Wyoming) | Abundant renewable energy, regulation-friendly | Rapid growth |

| Kazakhstan | Low energy costs, infrastructure upgrades | Stabilizing |

| El Salvador | Geothermal “Volcano” mining | Expanding slowly |

| Scandinavia (Norway, Iceland) | Green energy + cold climate | High potential |

| Middle East (UAE, Oman) | Subsidized energy + government support | Emerging hub |

These regions are shaping the future geography of global hash power — a trend expected to diversify Bitcoin’s security and decentralization further.

🔮 9. The Future Beyond 2025: Toward Efficiency and Decentralization

Looking ahead, the Bitcoin mining industry’s long-term success hinges on three pillars:

- Energy innovation — embracing carbon neutrality through renewable sources.

- Hardware advancement — pursuing ultra-efficient ASICs and modular data centers.

- Regulatory balance — global cooperation to standardize transparent, fair practices.

By 2030, Bitcoin mining may transition from being energy-intensive to energy-positive, contributing back to grids via renewable integration.

🧭 Conclusion: A Transformative Year Ahead

The Bitcoin mining industry outlook for 2025 is undeniably positive. Despite challenges from rising difficulty and tighter margins, innovation, sustainability, and institutional growth continue to propel the ecosystem forward.

With cleaner energy sources, smarter infrastructure, and global acceptance, Bitcoin mining is evolving from a niche industry into a cornerstone of the digital financial revolution.