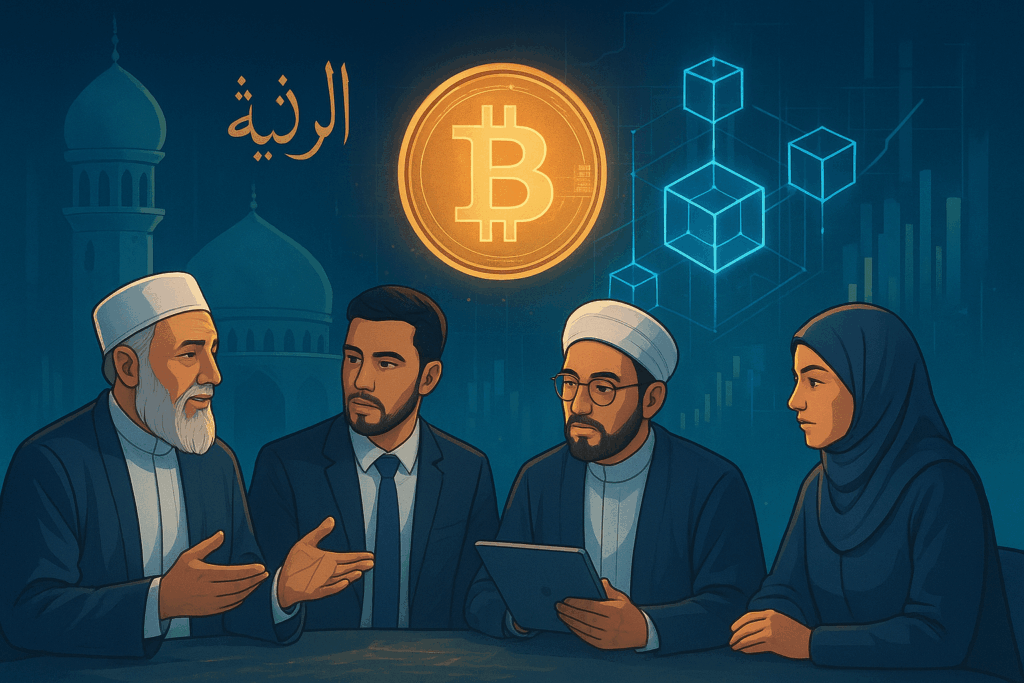

In the fast-evolving digital economy, cryptocurrency has captured global attention, revolutionizing how people invest and store value. Yet, for millions of Muslims worldwide, a crucial question persists — is cryptocurrency halal or haram according to Islamic law?

The intersection of religion and cryptocurrency represents not only a technological debate but also a moral and ethical one. As digital finance grows in popularity across the Muslim world, scholars, investors, and Islamic institutions continue to examine whether crypto aligns with Sharia principles.

🕌 Understanding the Foundation: Islamic Finance and Sharia Principles

To determine if crypto is halal or haram, we must first understand the core tenets of Islamic finance. Islam forbids riba (interest), gharar (excessive uncertainty), and maysir (gambling) — all practices that can lead to unjust gains or speculation.

According to IslamicFinanceGuru (IFG), a leading resource on Islamic finance and modern investment, any financial activity considered halal must involve tangible assets, transparency, and fair risk-sharing.

Thus, the question becomes: does cryptocurrency meet these conditions?

💠 What Scholars Say: Crypto Through an Islamic Lens

The Islamic scholarly community remains divided on the legitimacy of cryptocurrency. Some scholars view it as a speculative tool akin to gambling, while others see it as a decentralized innovation that promotes transparency and financial inclusion.

For example, the Malaysian Sharia Advisory Council, one of the first to address digital assets, has stated that crypto can be halal if it is used as a legitimate medium of exchange and not for speculation or illicit activity.

Meanwhile, in Indonesia, the National Ulema Council (MUI) initially declared cryptocurrency haram due to its speculative nature, but has since allowed certain Sharia-compliant crypto projects to operate under strict guidelines.

(Source: Al Jazeera – Islam and Bitcoin)

⚖️ Is Bitcoin Halal or Haram? Scholarly Analysis

The debate often centers around Bitcoin, the most well-known cryptocurrency.

✅ Arguments for Bitcoin Being Halal:

- Decentralization and Transparency:

Bitcoin operates on a public blockchain, reducing corruption and promoting fairness — principles aligned with Islamic ethics. - No Interest (Riba):

Bitcoin transactions are peer-to-peer, with no involvement of interest-based systems. - Store of Value:

Some scholars argue Bitcoin resembles gold, which is considered halal as a store of value and medium of exchange.

❌ Arguments for Bitcoin Being Haram:

- Speculation (Gharar):

High volatility may make crypto investments speculative, resembling gambling (maysir). - Lack of Tangible Backing:

Bitcoin doesn’t represent a physical asset, raising concerns about its intrinsic value. - Potential for Illicit Use:

Crypto can be used for unlawful activities, violating Islamic ethical norms.

As discussed in Investopedia’s analysis of Halal Investing, Islamic investors must ensure that their crypto activities avoid excessive uncertainty and adhere to ethical transparency.

🌐 Sharia-Compliant Crypto and Halal Blockchain Projects

In recent years, developers have created Sharia-compliant crypto projects designed to align with Islamic values. These coins and platforms exclude interest-based operations and speculative trading, focusing instead on real-world utility and asset-backed stability.

Some notable examples include:

- IslamicCoin (ISLM): Built on a blockchain with Sharia compliance, supporting ethical finance.

- CAIZcoin: A cryptocurrency that promotes transparency and follows Islamic economic principles.

Such initiatives reflect the global effort to make crypto investment halal, allowing Muslims to participate in digital finance without compromising their faith.

💹 Is Crypto Trading Halal?

Crypto trading is another area of debate. Trading purely for profit can easily cross into maysir (gambling) if it’s based on speculation rather than genuine value exchange.

However, long-term investment in credible blockchain projects — with clear use cases and transparent governance — can be viewed as halal, particularly when the investor understands the risks and intrinsic value of the asset.

According to CoinDesk’s coverage of crypto ethics, responsible investing and proper risk management can help align digital trading practices with religious ethics.

💰 Zakat and Cryptocurrency: Giving Back Through Faith

A growing question among Muslim investors is how to handle zakat (obligatory charity) on cryptocurrency holdings.

Most scholars agree that crypto, like gold or cash, is a form of wealth and thus subject to zakat if held for more than one lunar year. Tools such as Islamic zakat calculators are now emerging to help Muslims calculate zakat on digital assets with precision and compliance.

You can learn more from the Zakat Foundation’s digital asset guidelines for faith-based giving.

📜 Religion and Cryptocurrency: Global Fatwas and Rulings

Here are some key religious rulings from various Muslim-majority countries:

| Country | Islamic Authority | Verdict |

|---|---|---|

| Malaysia | Sharia Advisory Council | Halal if used ethically |

| Indonesia | MUI | Generally haram, but exceptions for regulated use |

| UAE | Central Bank & Scholars | Halal if backed by real assets |

| Turkey | Diyanet | Declared crypto haram (2021) |

| Saudi Arabia | Mixed opinions | Awaiting formal fatwa |

The diversity of opinions shows how dynamic and context-dependent this issue is — reflecting Islam’s adaptability to modern finance.

🌏 The Future: Islamic Fintech and the Rise of Ethical Crypto

The combination of Islamic finance principles and blockchain technology is paving the way for Islamic fintech — a fast-growing sector that aims to make financial inclusion ethical, transparent, and interest-free.

As Muslim investors demand more halal investment options, Sharia-compliant DeFi platforms and Islamic crypto exchanges are emerging, offering solutions that balance innovation with faith.

Even traditional Islamic banks are exploring blockchain for secure recordkeeping, cross-border zakat distribution, and smart contract-based finance.

🌟 Conclusion: The Path Toward Ethical Crypto Adoption

So, is crypto halal or haram?

The answer depends on intent, purpose, and transparency. When used ethically — avoiding speculation, ensuring asset-backed value, and contributing to the greater good — cryptocurrency can indeed be considered halal under Islamic finance principles.

Muslims entering the crypto space should seek guidance from trusted Islamic scholars and choose platforms committed to Sharia compliance and financial ethics.

The debate continues, but one thing is certain: religion and cryptocurrency together are shaping a new era of faith-based digital finance, empowering believers to invest with both profit and purpose.