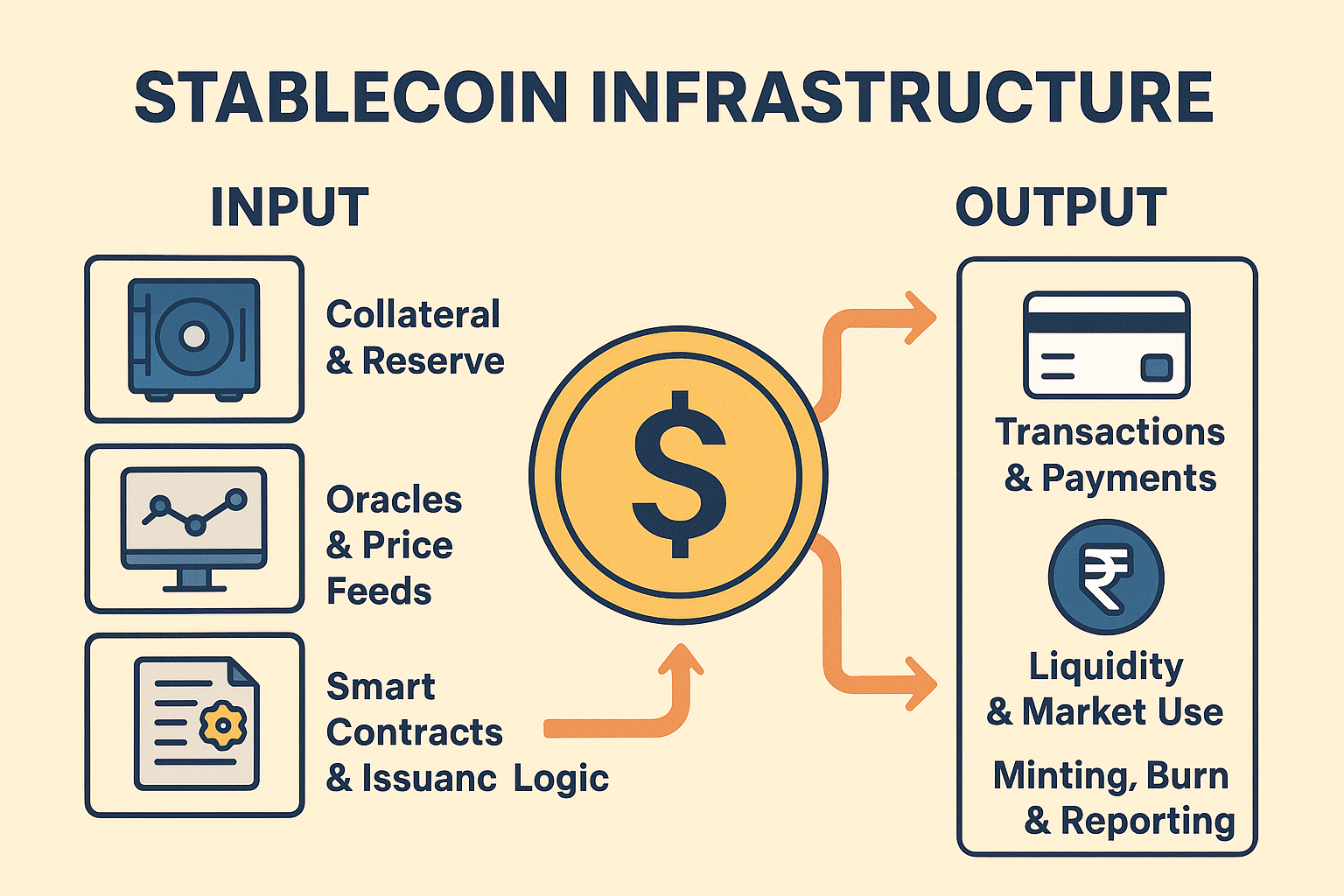

In the world of decentralized finance (DeFi) and blockchain, stablecoins play a pivotal role as pegged assets combining crypto-native properties with price stability. But behind every stablecoin lies a robust infrastructure that handles both the inputs (how they are backed, issued, governed) and outputs (how transactions, settlements, and use cases work). This article dives deep into the architecture, flows, challenges, and future of stablecoin infrastructure.

What Is Stablecoin Infrastructure?

Stablecoin infrastructure encompasses the full stack of systems, protocols, and mechanisms that support the creation, issuance, maintenance, and usage of stablecoins. It ensures:

- Price stability (pegging to a fiat or other asset)

- Transparency and auditability

- Liquidity and settlement capabilities

- Security, governance, and regulatory compliance

This infrastructure lies between traditional finance rails and blockchain-native systems, bridging fiat and crypto worlds.

Inputs: What Powers a Stablecoin?

The “input” side of stablecoin infrastructure covers how stablecoins are backed, governed, and created. Let’s break down the main components.

Collateral & Reserve Mechanisms

To keep the peg stable, stablecoins often rely on collateral or reserves. Input models include:

- Fiat-backed reserves: Real currency (USD, EUR, etc.) held in reserve by trusted custodians.

- Crypto-collateralized models: Using over-collateralization (e.g. ETH, WBTC) to back the token.

- Algorithmic / Seigniorage models: Non-collateral mechanisms that expand or contract supply based on demand.

- Hybrid models: Combining collateral + algorithmic levers.

The reserve assets must be highly liquid, auditable, and securely held. Oracles and auditing systems are inputs to feed real-time collateral valuations.

Oracles & Price Feeds

Oracles are data bridges that feed real-world or off-chain data (e.g. USD / ETH price) into smart contracts. They are a crucial input for:

- Rebalancing collateral ratios

- Triggering minting or burning of tokens

- Ensuring that the peg is maintained in volatile markets

Reliable, tamper-resistant oracles (e.g. Chainlink, Pyth) are foundational.

Smart Contracts & Issuance Logic

The issuance, redemption, and stabilization logic is embedded in smart contracts:

- Minting contracts accept collateral + parameters, issue stablecoins

- Redemption functions burn stablecoins and return collateral

- Stabilizer modules adjust supply or apply fees, rebalancing

- Governance modules to vote on parameters, upgrades

Security audits and formal verification of these contracts are critical inputs to trust and safety.

Governance & Regulatory Inputs

Governance mechanisms—whether on-chain DAO voting or centralized governance—determine:

- Collateral types and ratios

- Fee structure

- Reserve policies

- Upgrades and risk parameters

Additionally, regulatory compliance, KYC/AML processes, legal frameworks, and audits are non-technical but essential inputs to legitimize stablecoins in mainstream finance.

Outputs: What Does the Stablecoin Infrastructure Deliver?

The “output” side captures how this infrastructure serves users, markets, and systems. What stablecoin infrastructure produces in practice:

Transactions & Payments

Stablecoins enable:

- Fast, near-instant payments (on-chain)

- 24/7 settlement across time zones

- Low-cost cross-border remittances, with fewer intermediary fees

Liquidity & Market Use

Once issued, stablecoins enter the broader crypto and DeFi ecosystem:

- Liquidity pools / AMMs (automated market makers) for trading

- Collateral in lending/borrowing protocols

- Bridges / cross-chain transfers

- Use in derivatives, payments rails, merchant integrations

Minting / Burning (Supply Adjustments)

Stablecoin infrastructure outputs changes in token supply:

- When users deposit collateral → minting occurs

- When users redeem stablecoins → burning occurs

- Stabilization mechanisms may inflate or contract supply based on market dynamics

Reporting, Transparency & Audits

Outputs should include:

- Reserve reports / audits to ensure that backing is as claimed

- On-chain data dashboards showing circulation, collateralization ratios

- Error oracles / alarms if system falls out-of-bounds

These outputs enhance user trust and legitimacy.

Integration & Interoperability

Stablecoin infrastructure outputs APIs, SDKs, and modules so that:

- Payment platforms can integrate stablecoins

- Exchanges can list and settle stablecoins

- Wallets, point-of-sale systems, DeFi platforms can use them easily

Outputs thus include software toolkits, interface modules, and bridge adapters.

Flow: Input → Processing → Output

Here’s a simplified flow:

- User / institution deposits collateral (input)

- Oracle fetches price data; system verifies collateral

- Smart contract mints stablecoins (processing)

- The stablecoins enter circulation (output)

- Users transact, lend, redeem

- Redemption triggers burn → return collateral

- Monitoring & adjustments happen continuously

Throughout, governance and risk controls run in parallel.

Challenges & Risks in Input/Output Systems

Collateral Risk & Volatility

If collateral assets (e.g. ETH) sharply drop, the system can become under-collateralized.

Oracle Manipulation & Delays

Faulty price feeds can trigger incorrect mint/burn operations or peg breaches.

Smart Contract Bugs & Exploits

Vulnerabilities can lead to loss of reserves or peg failures.

Liquidity Crises

During market stress, users may rush redemptions, causing shortages or insolvency.

Regulatory Pressure

If the legal framework is unfavorable, outputs (in terms of adoption) may be constrained.

Case Study & Real-World Examples

- Bastion: A platform enabling companies to issue stablecoins without building custom infrastructure.

- Consumer Protection Integration: For stablecoins to compete with Visa/Mastercard, infrastructure must support chargebacks, fraud protection, and resolution — making these outputs as tangible policy features.

These show how input design decisions flow into real-world outputs and adoption.

Future Trends & Innovations

- Programmable money + smart wallets

- Cross-chain stablecoin interoperability

- Composable DeFi modules

- Regulated stablecoin rails (e.g. central bank digital currency integration)

- Decentralized governance with greater stability controls

These advances will reshape both inputs (new collateral types, modular oracles) and outputs (new use cases, deeper integration with traditional finance).

Conclusion

Understanding the input and output of stablecoin infrastructure is key to appreciating how stablecoins deliver value, maintain stability, and integrate into broader financial systems. A well-designed infrastructure begins with reliable collateral, oracles, governance, and smart contract logic, and results in secure issuance, high liquidity, fast payments, transparency, and extensibility.

As stablecoin adoption grows, optimizing both sides of the architecture will be central to building trust, scalability, and real-world utility.